This will be one of the most interesting quarters in recent memory. The Fed has got to choose its poison. Do they stand pat once again next week, leaving rates “higher for longer” and awaiting more data? Or do they finally take the step that just about everyone is waiting for them to take and start a cycle of interest rate cuts to save our economy from spiraling lower?

One side is the inflation side, which perhaps is not convinced that we’re out of the woods. The other side, which I’m on, is watching closely as initial economic warning signs begin to emerge. This side believes that the inflation job is essentially done, while waiting too long to lower rates may unnecessarily result in an upcoming recession and, potentially, a big market decline.

Pick your side.

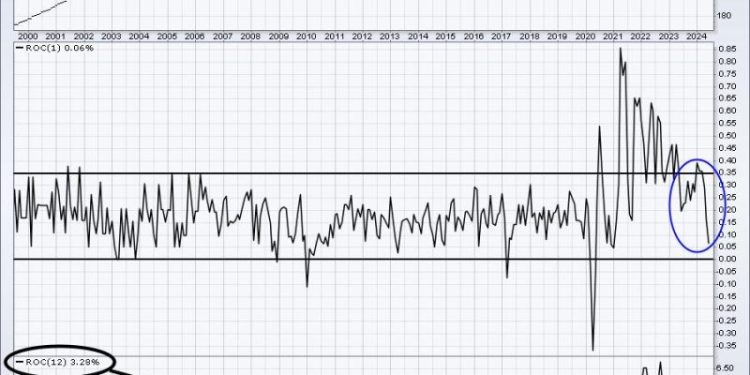

Listen, there are genuine arguments on both sides. I would definitely be much more comfortable, however, debating the merits of cutting rates NOW. First, the Fed has called for a sustainable path toward its 2% core inflation target at the consumer level. I can’t help but look at the Core CPI chart below and wonder how much more sustainability the Fed needs to see before attacking the slowing economy. Remember, the Fed has two mandates, not one. It strives to maximize employment and stabilize prices. It’s spent the past few years doing the latter, and it’s time to focus on maximizing employment. Here’s the current Core CPI picture:

The one-month rate of change (ROC) of Core CPI has been trending lower since peaking in early 2021. That’s three years of a sustainable decline. I’m really not sure how much longer the Fed needs to see it drop unless they’re literally waiting for it to hit 2%. Furthermore, the last reading in June showed the lowest reading yet—just 0.006%, less than one-tenth of one percent. The last two months’ Core CPI readings, annualized, is just 1.32%. Again, what do we need to see?

Many argue that the economy has remained resilient and doesn’t need any help. That is partly true, but the fed funds rate was not hiked multiple times due to a weak economy. Rates were hiked to stave off further inflationary pressures. Once those inflationary pressures are subdued, there’s no reason to keep rates elevated. It only risks the Fed’s other mandate to maximize employment.

To give you one example of the beginning of economic weakness, check out the history of initial jobless claims and their tight correlation with previous recessions:

The 2020 recession is in red because it’s the oddball. That recession had little to do with systemic economic weakness and instead occurred out of our first pandemic in 100 years. The other six, however, were directly tied to economic weakness. Before the start of each of those six recessions, the initial jobless claims began rising. Rising claims lead to a rising unemployment rate, which is a harbinger of poor economic activity to come.

Folks, we’re at a major crossroads here. I’ve maintained my steadfast secular bull market position since 2013, briefly turning bearish as corrections and cyclical bear markets unfolded. Currently, I believe we remain in a secular bull market. The Fed, though, needs to cut rates now, or my long-term position may change. Powell, forget about the ghost of inflation and address the problem at hand, before it’s too late!

Whether we can (1) withstand Q3 weakness and return to all-time highs quickly or (2) spiral lower into year-end will depend a great deal on Fed action or inaction. And, like I said, maybe they’ve sat on their hands too long already. There are critical technical, historical, and economic signals to be aware of to navigate what we’re about to go through. It’s important enough that I’ve decided to host a webinar for our EarningsBeats.com members on Saturday morning at 10:00am ET, “Why The S&P 500 May Tumble”. This session is FREE to EarningsBeats.com members, including FREE 30-day trial subscribers. I believe you will appreciate this walk through history and understand the implications of Fed actions should you attend. For more information and to register for this critical event, CLICK HERE.

I hope to see you there!

Happy trading!

Tom